Ponzi System Explained

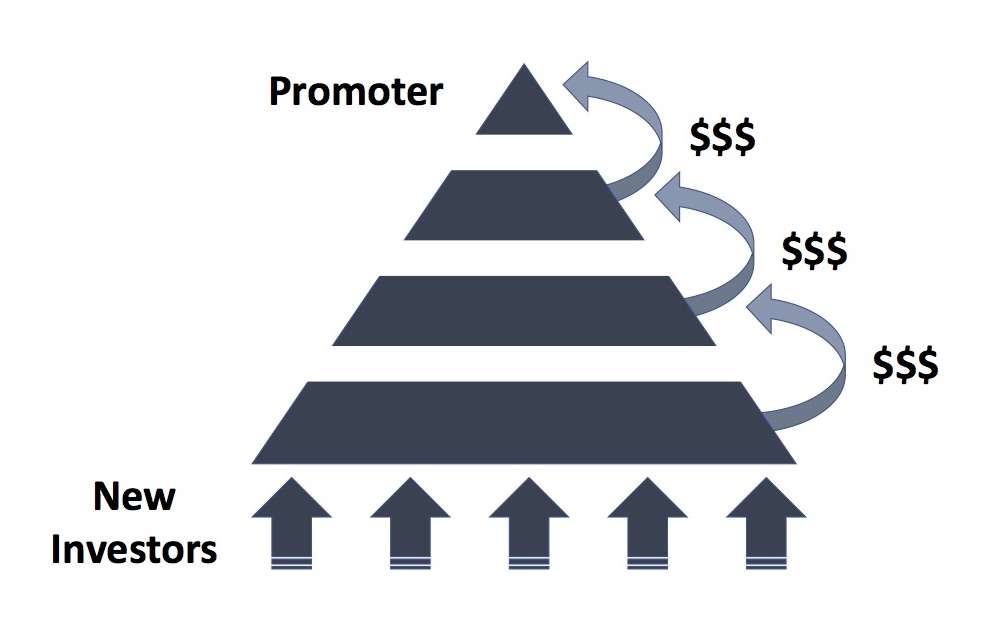

A Ponzi system is a fraudulent investment scheme where returns for earlier investors are paid using the money contributed by newer investors. This type of scheme creates an illusion of a profitable business or investment, but it does not generate real profits. It relies solely on attracting a continuous flow of new participants to stay operational.

How a Ponzi Scheme Works

- Attracting Investors:

The organizer lures participants by promising high and consistent returns, often with minimal or no risk. - Paying Earlier Investors:

Returns for the first group of investors are paid using funds from new participants rather than legitimate earnings. This builds trust in the scheme. - Encouraging Reinvestment:

Satisfied early investors reinvest their profits, and word-of-mouth helps attract new participants. - The Scheme Expands:

As more people join, the organizer continues using funds from new investors to pay existing participants. - The Collapse:

Eventually, the scheme runs out of new participants, or the organizer disappears with the remaining funds, leaving most investors with losses.

Key Features of a Ponzi System

- Unrealistic Returns: Promises of guaranteed, high, and steady profits regardless of market conditions.

- No Legitimate Business Model: There is no real business or investment generating profits; it’s just redistribution of money.

- Recruitment Dependency: Success depends on constantly recruiting new investors.

- Inevitable Failure: The system collapses when the flow of new participants slows or stops.

Ponzi System Explained

Why People Fall for Ponzi Schemes

- Trust in Early Success: Initial investors often report receiving their returns, which builds credibility.

- Social Proof: Friends, family, or influencers may unknowingly promote the scheme.

- Lack of Financial Knowledge: Many people don’t recognize the red flags of an unsustainable system.

Famous Ponzi Schemes

- Charles Ponzi (1920): The original scheme, which promised high returns from postal reply coupons.

- Bernie Madoff (2008): A massive Ponzi scheme defrauding investors of $65 billion.

- Crypto Scams: Recent schemes using cryptocurrencies to attract victims under the guise of blockchain technology.

How to Avoid a Ponzi Scheme

- Do Your Research: Investigate the company and ensure it’s registered with financial regulators.

- Be Skeptical of High Returns: Avoid investments with “guaranteed” high profits.

- Understand the Business Model: Ask how profits are generated and verify their legitimacy.

- Consult Experts: Seek advice from trusted financial advisors before investing.