FAQ – Ponzi Schemes

1. What is a Ponzi Scheme?

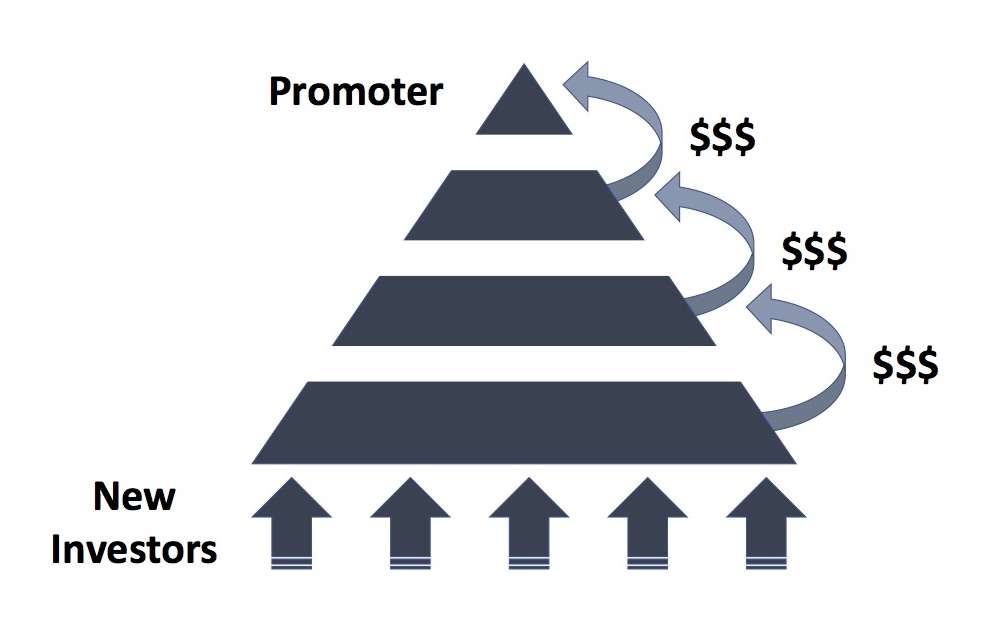

Ponzi schemes is a fraudulent investment operation where returns to earlier investors are paid using the funds from newer investors, rather than from legitimate profits.

2. How Does a Ponzi Scheme Work?

- Step 1: The scammer attracts investors with promises of high, consistent returns.

- Step 2: Initial returns are paid out to build trust, but these come from funds contributed by new investors.

- Step 3: The scheme collapses when new investments slow down or too many investors demand withdrawals.

3. Why Do Ponzi Schemes Collapse?

They rely on a continuous influx of new investors to pay returns. When the inflow of new money stops or withdrawals exceed, the available funds, the scheme falls apart.

4. What Are the Warning Signs of a Ponzi Scheme?

- Guaranteed high returns with little or no risk.

- Lack of transparency about the investment strategy.

- Pressure to act quickly or „limited-time“ offers.

- Promoters who are not registered with financial authorities.

- Difficulty withdrawing funds or excuses for delays.

5. Who Was Charles Ponzi?

Charles Ponzi was an Italian-born con artist who popularized the scheme in the 1920s. He promised investors huge profits through arbitrage in international postal reply coupons but paid returns using funds from new investors.

6. How Is a Ponzi Scheme Different from a Pyramid Scheme?

- Ponzi Scheme: Focuses on investment fraud where returns come from new investors. Recruitment may not be emphasized.

- Pyramid Scheme: Relies heavily on recruiting participants, with members earning rewards by bringing in others.

7. Are All High-Return Investments Ponzi Schemes?

No, legitimate investments can also offer high returns. The key difference is that legitimate opportunities are backed by real assets or businesses, while Ponzi schemes lack a legitimate revenue source.

8. What Are Some Famous Ponzi Schemes?

- Bernie Madoff: Operated the largest Ponzi scheme in history, defrauding investors of $65 billion.

- Bitconnect: A cryptocurrency scam promising unrealistically high returns.

- Stanford Financial Group: A $7 billion Ponzi scheme disguised as a legitimate financial firm.

9. How Can I Protect Myself from a Ponzi Scheme?

- Research the investment and its promoters thoroughly.

- Verify registration with financial regulatory bodies.

- Avoid investments that promise guaranteed returns with no risk.

- Be cautious of unsolicited investment offers.

- Seek advice from licensed financial professionals.

10. Are Ponzi Schemes Illegal?

Yes, Ponzi schemes are illegal because they defraud investors by misrepresenting the source of returns and eventually lead to financial losses for most participants.

11. What Happens to Victims of a Ponzi Scheme?

Victims often lose their investments, but they may be able to recover part of their losses through legal action or bankruptcy proceedings against the scheme operators. However, recovery can take years and may be partial.

12. Can Modern Ponzi Schemes Involve Cryptocurrency?

Yes, cryptocurrencies are sometimes used in Ponzi schemes, as they can attract people with promises of high returns and exploit the lack of regulation in the crypto market.

By staying informed and vigilant, you can reduce the risk of falling victim to a Ponzi scheme.