How Do Ponzi Schemes Work?

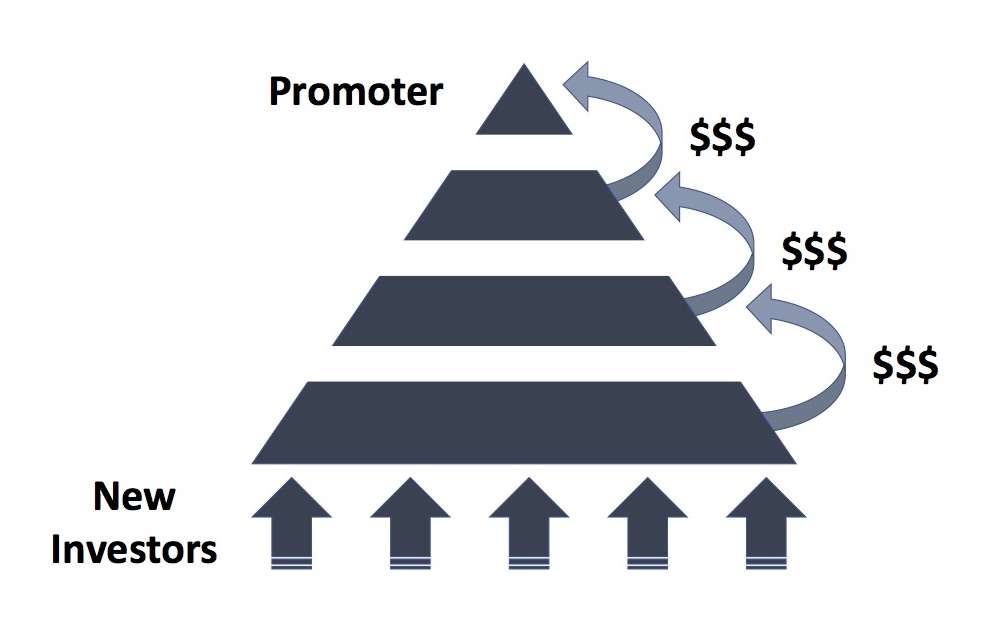

A Ponzi scheme is a fraudulent financial operation where returns for earlier investors are paid using the funds from newer investors, rather than through legitimate business profits. These schemes rely entirely on a constant flow of new participants to keep operating and eventually collapse when the flow of new money dries up.

Steps of a Ponzi Scheme

- Attracting Investors:

- The organizer promotes the scheme, offering high, consistent, and often guaranteed returns with little or no risk.

- They often use persuasive marketing and sometimes a facade of legitimacy, like a fancy office or website.

- Using New Money to Pay Old Investors:

- Early investors receive their promised returns, which creates the illusion that the scheme is profitable.

- These returns are not generated from profits but are taken from the money contributed by newer investors.

- Building Trust:

- The initial payouts encourage reinvestment and attract new participants, including friends and family of the first investors.

- Word-of-mouth or testimonials further increase credibility.

- Growing the Scheme:

- As the pool of investors grows, more money flows in, but the scheme’s structure becomes unsustainable because payouts rely on new investments.

- Collapse:

- The scheme eventually collapses when it cannot attract enough new investors to cover withdrawals and payouts.

- Organizers often disappear with the remaining funds, leaving most participants with significant losses.

How Do Ponzi Schemes Work?

Key Elements of a Ponzi Scheme

- Unrealistic Returns: Promises of consistently high and guaranteed profits, regardless of market conditions.

- Lack of Transparency: No clear explanation of how profits are generated.

- Recruitment Dependency: Requires an ever-growing number of new investors to maintain payouts.

- Short-Term Success: Early participants may receive payouts, which builds trust and attracts more people.

How Do Ponzi Schemes Work? Example of How It Works

- Initial Stage:

- 10 people each invest $1,000, totaling $10,000.

- The organizer promises a 50% return ($500) within a month.

- First Payout:

- After one month, the organizer uses $5,000 from the initial pool to pay returns to 10 investors.

- The investors are convinced the system works and may reinvest or recommend it to others.

- Expansion:

- 20 new investors join, contributing $20,000.

- The organizer uses $15,000 to pay returns to earlier participants, keeping $5,000 as profit.

- Collapse:

- When the number of new investors declines, the organizer cannot meet payout demands and disappears with the remaining funds.

Why Do Ponzi Schemes Fail?

- They are unsustainable because they depend on infinite growth, which is impossible.

- As more people try to withdraw their funds, the scheme runs out of money.

- Regulatory agencies or law enforcement often expose the fraud, leading to its collapse.